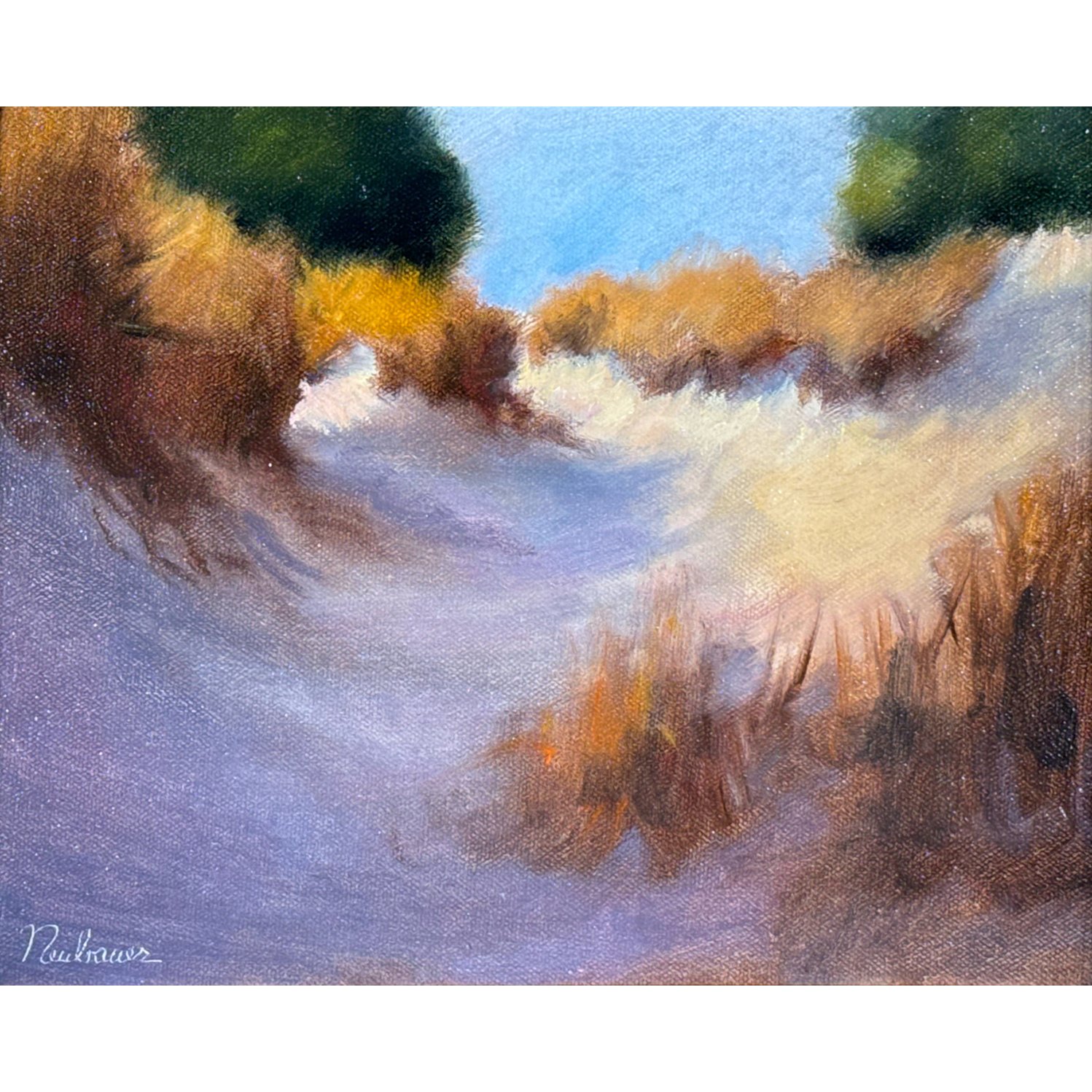

reliable estate appraisals

ESTATE SETTLEMENT

INSURANCE VALUATION

AUCTION ESTIMATE

Professional objective assessments that your family, your lawyer, and your tax advisor can rely upon. Our team has over 40 years combined experience in identifying value and authoring appraisals always to the latest Uniform Standards of Professional Appraisal Practices (USPAP).

A Personal Property Estate Appraisal can serve several purposes, all related to determining the value of personal belongings or assets within an estate or collection. Some common reasons for engaging an appraiser are:

Estate Settlement: Valuation may be required, and helps determine the overall value of the estate for inheritance, tax, and distribution purposes.

Equitable Distribution: If there are multiple beneficiaries or heirs to an estate, knowing the value of personal property ensures fair distribution.

Planning Purposes: Estate appraisals can also be useful for estate planning while the owner is still alive. Knowing the value of personal property can inform decisions regarding gifts, trusts, or other arrangements to be made during the owner's lifetime.

Taxation Purposes: In many jurisdictions, estate taxes or inheritance taxes may apply based on the total value of the estate. Accurate appraisals of personal property help in calculating these taxes correctly.

Insurance Purposes: Clients may wish to provide their insurer with an enumerated list of belongings and their current values to improve the quality of their coverage

Alex Fonarow

Owner, Appraiser, & Auctioneer

Areas of Specialty: Fine Art, Jewelry, Decorative Arts, Antique & Mid Century Furniture.

To get more information about our Appraisal Services, or to schedule an Appraisal, fill out the form below or call (475) 500-7108